The Southern Genealogist’s Exchange Society, Inc. (SGES) is classified as a non-profit organization under the Internal Revenue Code Section 501(c)3. As such, SGES contributions are tax-deductible in accordance with Code section 170.

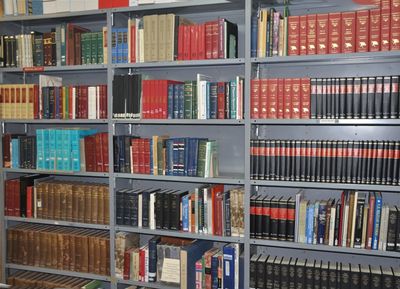

SGES exists to foster and support genealogy research for those who share our passion in discovering respective descendants. To that end we operate a genealogy library with more than 8,000 volumes. Internet access and office computers are available for research. Volunteers are available to assist in research efforts.

Our support of genealogy research unfortunately is not without cost. Typical operating costs to maintain a Library Building, provide office supplies, equipment, internet services and the like all must be paid for. You can make the difference in the services we provide. Your cash contribution as well as regular SGES membership dues helps us continue as a tremendous resource for genealogy research.

Contributions established in your name, community organization, company, or in memory of a friend or family member can also be made to SGES. Legacy contributions may be made through wills and simple probate-avoidance devices (such as living trusts and beneficiary designations on IRAs, 401(k) s, and other financial and investment instruments).

Any contribution amount is gratefully accepted. Please make your tax-free donations contribution payable to:

The Southern Genealogist’s Exchange Society, Inc.

P.O. Box 7728

Jacksonville, Florida 32238